trust capital gains tax rate 2020 table

Below are the tax rates and income brackets that would apply to estates and trusts that were opened for deaths that occurred in 2021. By Soutry Smith Income Tax.

Charitable Remainder Trusts Crts Wealthspire

In 2020 to 2021 a trust has capital gains of 12000 and.

. Ad Bank of America Private Bank Can Help Create Personalized Impact Investing Plans for You. The following Capital Gains Tax rates apply. Income and short-term capital gain generated by an irrevocable trust gets taxed at high rates.

The tax rate on most net capital gain is no higher than 15 for most individuals. The tax-free allowance for trusts is. The following are some of the specific exclusions.

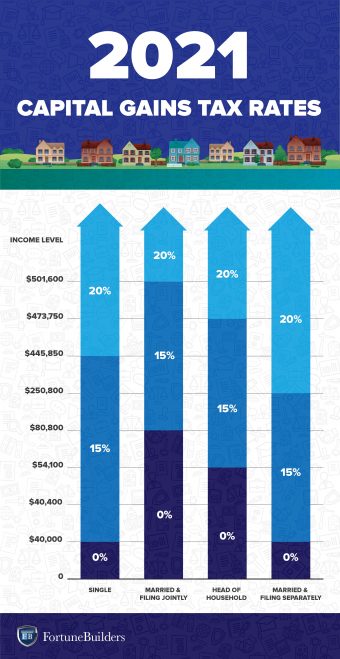

Ad Bank of America Private Bank Can Help Create Personalized Impact Investing Plans for You. One year or less. 2021 Long-Term Capital Gains Trust Tax Rates.

Irrevocable trusts are very different from revocable trusts in the way they are taxed. Capital Gain Tax Rates. Trustees only have to pay Capital Gains Tax if the total taxable gain is above the trusts tax-free allowance called the Annual Exempt Amount.

Trusts and estates pay. They would apply to the tax return. Ad Search For Tax Rates Capital Gains 2020.

Powerful and Easy to Use. Some or all net capital gain may be taxed at 0 if your taxable income is less than. Based on the capital gains tax brackets listed earlier youll pay a 15 rate so the gain will add 300 to your tax bill for 2020.

Events that trigger a disposal include a sale donation exchange loss death and emigration. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. For tax year 2020 the 20 rate applies to amounts above 13150.

The remaining amount is taxed at the current rate of Capital Gains Tax for trustees in the 2021 to 2022 tax year. Because tax brackets covering trusts are much smaller than those for individuals you can quickly rise to the maximum 20 long-term capital gains rate with even modest profits. More than one year.

10 and 20 tax rates for individuals not including residential property and carried interest. First deduct the Capital Gains tax-free allowance from your taxable gain. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

Learn How EY Can Help. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income. The Internal Revenue Service recently published its annual inflation-adjusted figures for 2020 for estate and trust income tax brackets as well as the exemption amounts.

18 and 28 tax rates for individuals. Ad Estate Trust Tax Services. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed.

Ordinary income tax rates up to 37. The 2020 estimated tax. Trust capital gains tax rate 2020 table Saturday March 19 2022 Edit.

The maximum tax rate for long-term capital gains and qualified dividends is 20. An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by filing. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

Add this to your taxable. Ad Browse Discover Thousands of Law Book Titles for Less. 2022 Long-Term Capital Gains Trust Tax Rates.

Make Your Searches 10x Faster and Better. Its also worth noting that if youre on the cusp of. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets.

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

Understanding Charitable Remainder Trusts

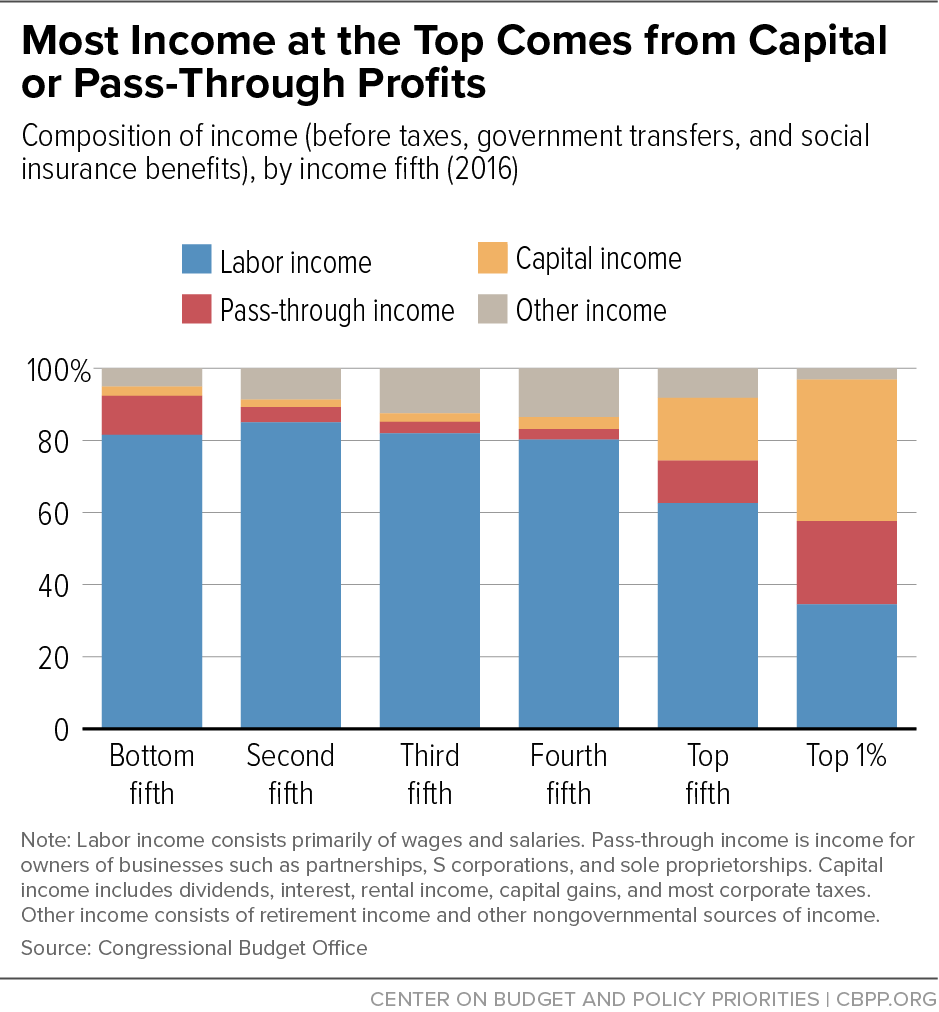

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

2021 Tax Rates And Exemption Amounts For Estates And Trusts Preservation Family Wealth Protection Planning

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

Tax On Farm Estates And Inherited Gains Farmdoc Daily

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Florida Real Estate Taxes What You Need To Know

Charitable Remainder Trust Calculator

Soi Tax Stats Irs Data Book Internal Revenue Service

Income Tax And Capital Gains Rates 2020 Skloff Financial Group

Great Time For A Grat Journal Of Accountancy

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

Dividend Tax Rate For 2022 Smartasset

State Income Tax Rates And Brackets 2021 Tax Foundation

Capital Gains Tax Brackets For 2022 And 2023 The College Investor